The good news is doing this calculation is simple and it gives you the information you need to calculate other important accounting numbers as well, including your accounts receivable turnover ratio. This guide will teach you what net credit sales are, where it is on a balance sheet, and how to calculate it. Net credit sales, on the other hand, deducts any discounts or returns from the gross credit sales to show the actual amount of revenue generated from credit sales. This figure is important for assessing the company’s profitability and performance.

Operations

Understanding net credit sales is essential for both external stakeholders, such as investors and creditors, as well as internal stakeholders, including management and shareholders. It provides insights into the company’s ability to generate sales volume and evaluate the effectiveness of its credit policies. When recording a credit card or debit card sales using the net method, the company will receive the cash minus the fee of the card processing company.

Discounts

This type of transaction runs counter to a cash deal, which mandates that a client pay before a vendor ships goods or performs services. To record a credit sale, a corporate bookkeeper debits the customer receivables account and credits the sales revenue account. Don’t mistake a credit sale for a credit transaction, which generally pertains to a borrowing arrangement. In addition to the cash flow from operations, the statement of cash flows also includes the cash flow from investing activities and financing activities. These sections provide insights into the company’s capital expenditure, investment decisions, and financing activities such as issuing or repurchasing equity and debt. Find out where to locate this important financial metric in the realm of finance.

Optimizing Credit Policies for Better Sales Management

Imagine your business generates $50,000 in gross credit sales during the month. However, one customer returns $4,000 worth of goods due to quality issues, and another is granted a $1,500 sales allowance because of a pricing error. Additionally, you offered a 2% early payment discount to incentivize prompt payment, and a few customers took advantage, totaling $800 in discounts. Net credit sales are sales made on credit and are the revenues your business generates on account of selling goods to customers on credit.

Sales revenue increases a company’s net income, which ultimately flows into retained earnings, which is an equity statement item. Next, we will discuss the importance of net credit sales in financial analysis and decision-making. Net sales are the deals that record specific changes made once the merchandise is sold.

- Gross sales are the total amount of credit sales recorded, while net credit sales refer to the sales after deducting any sales allowance or credit arrangements.

- For businesses that extend credit to their customers, accurately tracking net credit sales is essential for effective financial management and decision-making.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

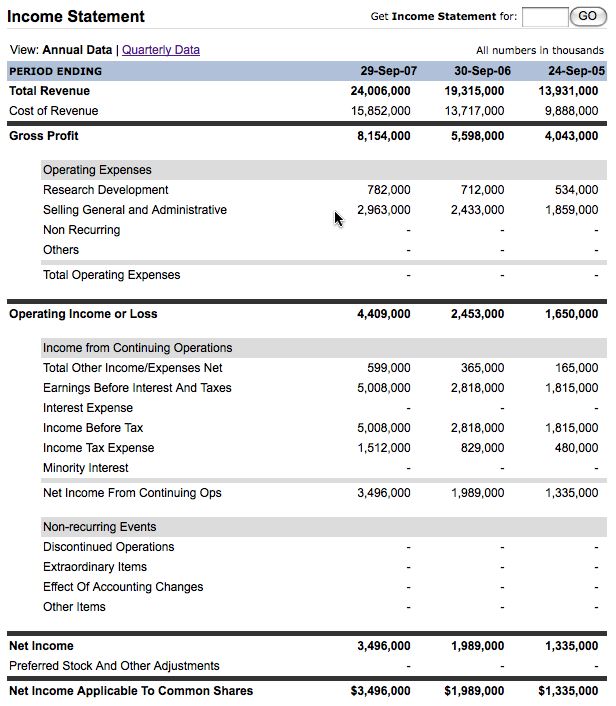

- The income statement is a financial statement used to analyze a company’s revenues, revenue growth, and operating expenditures.

- But a minimum knowledge of the accounts and the net credit sales will help you make the new business policy to grow your company.

- This can ultimately lead to increased customer loyalty and higher levels of net sales over time.

Net Credit Sales on Financial Statements & Ratios

Credit Sales refer to the revenue earned by a company from its products or services, where the customer paid using credit rather than cash. The higher the positive net credit sales, the more revenue the company is expecting from credit sales. Data can change quickly, and if you’re not regularly updating your sales figures, you might be working with outdated information. Make it a habit to review and update your data frequently to ensure you’re always working with the most accurate numbers. Ignoring these figures can lead to an inflated net credit sales number, which gives you a false sense of security about your revenue.

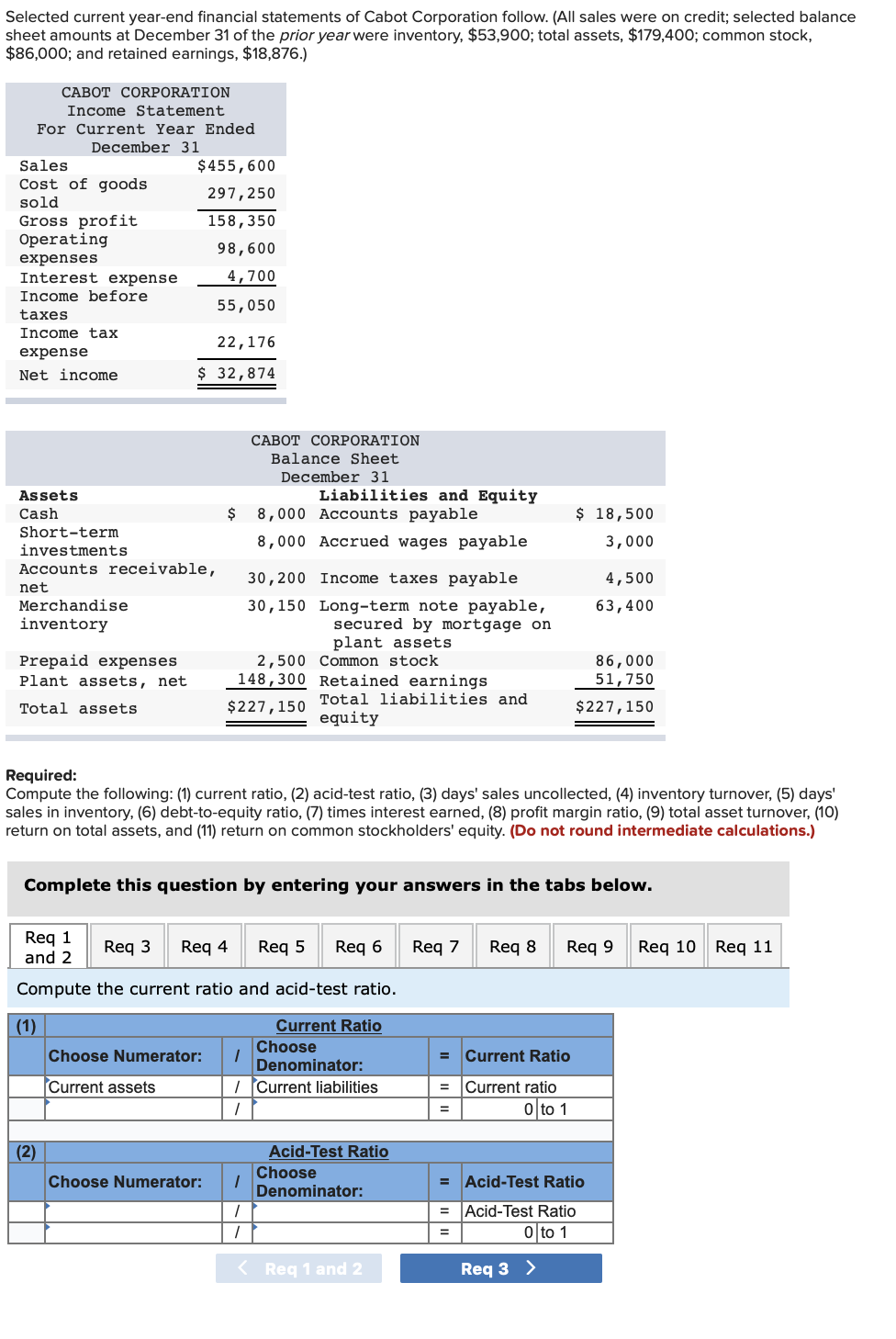

In conclusion, finding net credit sales on financial statements requires a thorough understanding of the income statement, balance sheet, and statement of cash flows. By following the steps outlined in this article, you can easily find net credit sales and use this important metric to evaluate your company’s performance and make informed financial decisions. Net credit sales is a financial metric that represents the total value of goods or services sold by a company on credit, after deducting any sales returns, allowances, and discounts given to customers. It is an important indicator of a company’s ability to generate revenue through credit sales transactions.

For example, if terms stipulate payment within 30 days, the business would aim to collect within 20 days. Allowances are less frequent than refunds, although they may be necessary if a corporation seeks to reduce previously booked income. A seller may offer a partial refund to a buyer who claims that products were damaged during shipment or that the wrong goods were received in order. A seller would need to credit an asset account and debit a sales returns and allowances account. The three primary charges that might affect net sales are sales returns, allowances, and discounts. As a result, in order to enable adequate performance analysis, each of these sorts of charges will need to be accounted for across a company’s financial reporting.

It is important for a company’s liquidity and cash flow that accounts receivable be collected—or turned into cash—in a timely fashion. Before we dive into where to find net credit sales on financial statements, let’s briefly define what it is. Net credit sales is the total amount of sales made on credit, minus the amount of returns, allowances, and bad debts. For example, if a company sells $100,000 worth of goods on credit and subsequently receives $20,000 in returns and allowances, the net credit sales would be $80,000. Changes in net credit sales can affect the operating cash flow by influencing the accounts receivable balance.

When you maintain the right amount of credit sales limit after the limit, you can not sell the goods based on the credit. So if you want to gain more profit, use the credit sales limit and try to make sales with cash transactions. To figure out where to find net credit sales on financial statements the correct number of net credit sales, you have to subtract the allowance amount from the whole sales returns. Then when you are going again to remove the number from the crest sales, you will find the correct number of net credit sales.

Overall, net credit sales provide essential information for evaluating a company’s revenue generation, credit management, and financial performance. By analyzing this metric and its impact on financial statements, stakeholders can make more informed decisions, mitigate risks, and drive business growth. On the other hand, a low ratio suggests that the company may be experiencing delays in collection, potentially leading to cash flow problems and higher bad debt expenses. In the Accounts Receivable Turnover Ratio formula, net credit sales serve as the numerator, representing the total sales made on credit after accounting for returns, allowances, and discounts. This figure is crucial because it shows the actual revenue the company expects to collect from credit transactions.